20 Good Tips For Choosing Incite Ai Stocks

20 Good Tips For Choosing Incite Ai Stocks

Blog Article

Top 10 Tips To Diversify Data Sources In Ai Stock Trading From The Penny To The copyright

Diversifying data sources is crucial to develop strong AI stock trading strategies that are effective across penny stocks as well as copyright markets. Here are ten top suggestions for integrating and diversifying sources of data in AI trading:

1. Use Multiple Financial Market Feeds

TIP: Collect a variety of financial data sources such as copyright exchanges, stock markets, OTC platforms and other OTC platforms.

Penny Stocks are listed on Nasdaq Markets.

copyright: copyright, copyright, copyright, etc.

What's the problem? Relying solely on a single source of information could cause inaccurate or biased information.

2. Social Media Sentiment data:

Tip: Use platforms such as Twitter, Reddit and StockTwits to analyze sentiment.

To discover penny stocks, keep an eye on specific forums such as StockTwits or the r/pennystocks forum.

copyright-specific sentiment tools like LunarCrush, Twitter hashtags and Telegram groups are also useful.

What's the reason? Social media can generate fear or excitement particularly with speculative stocks.

3. Utilize macroeconomic and economic data

Include statistics, for example GDP growth, inflation and employment figures.

Why: Broader economic trends affect market behavior, and provide an explanation for price movements.

4. Use blockchain data to track the copyright currencies

Tip: Collect blockchain data, such as:

The activity of spending money on your wallet.

Transaction volumes.

Inflows and Outflows of Exchange

Why: On-chain metrics give a unique perspective on trading activity and the investment behavior in copyright.

5. Incorporate other sources of information

Tip : Integrate data of unusual kinds like:

Weather patterns (for agriculture and other sectors).

Satellite imagery (for logistics, energy or other purposes).

Analysis of Web traffic (for consumer sentiment)

Why alternative data can be used to create new insights that are not typical in alpha generation.

6. Monitor News Feeds & Event Data

Utilize NLP tools to scan:

News headlines

Press releases

Announcements regarding regulations

News can be a risky element for penny stocks and cryptos.

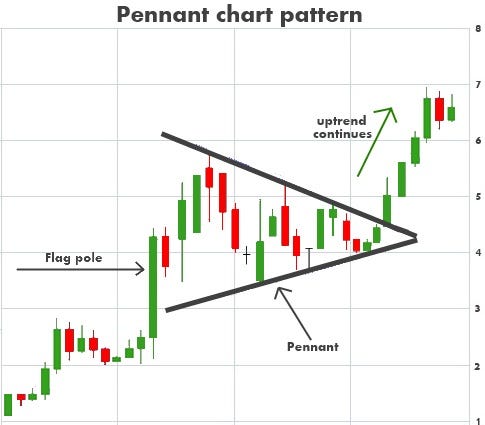

7. Follow Technical Indicators and Track them in Markets

Tip: Make sure you diversify your data inputs with different indicators

Moving Averages

RSI, or Relative Strength Index.

MACD (Moving Average Convergence Divergence).

Why: Mixing indicators improves the accuracy of predictions and prevents over-reliance upon a single indicator.

8. Include historical and real-time information.

Mix historical data for backtesting using real-time data while trading live.

Why: Historical information validates strategies, while real-time market data adapts them to the conditions at the moment.

9. Monitor the Regulatory Data

Be on top of new tax laws, policy changes and other important information.

Keep an eye on SEC filings to stay up-to-date on penny stock compliance.

Follow government regulations, the adoption of copyright or bans.

Why: Changes in regulation could have immediate and significant effects on the market.

10. AI Cleans and Normalizes Data

Tips: Make use of AI tools to preprocess the raw data

Remove duplicates.

Fill in the blanks using missing data.

Standardize formats for various sources.

Why? Normalized and clean data is crucial to ensure that your AI models perform optimally, free of distortions.

Take advantage of cloud-based software to integrate data

Tip: To consolidate data efficiently, make use of cloud-based platforms like AWS Data Exchange Snowflake or Google BigQuery.

Cloud solutions make it simpler to analyse data and combine diverse datasets.

By diversifying your data you can increase the stability and adaptability of your AI trading strategies, regardless of whether they are for penny stock or copyright, and even beyond. Follow the most popular ai trading app blog for blog info including stock market ai, ai trading software, ai for trading, stock ai, ai stocks, ai for stock trading, ai stocks to buy, ai stock picker, ai stocks to buy, incite and more.

Top 10 Tips For Ai Investors, Stockpickers, And Forecasters To Pay Attention To Risk-Related Metrics

If you pay attention to risk metrics You can ensure that AI stocks, forecasts and investment strategies and AI are able to withstand market volatility and are balanced. Knowing and managing your risk can aid in avoiding massive losses and allow you to make informed and based on data-driven decisions. Here are 10 tips for integrating AI into stock picking and investment strategies.

1. Know the most important risks: Sharpe ratio, maximum drawdown, and the volatility

Tips: To evaluate the performance of an AI model, pay attention to important metrics like Sharpe ratios, maximum drawdowns and volatility.

Why:

Sharpe ratio is a measure of the return on investment relative to the risk level. A higher Sharpe ratio indicates better risk-adjusted performance.

Maximum drawdown is the most significant peak-to-trough loss, helping you understand the potential for massive losses.

Volatility is the measure of the risk of market and fluctuations in price. Higher volatility means greater risk, while less volatility suggests stability.

2. Implement Risk-Adjusted Return Metrics

Tips: To assess the actual performance, you can use metrics that are risk-adjusted. They include the Sortino and Calmar ratios (which focus on the risks associated with a downturn) and the return to drawdowns that exceed maximum.

The reason: These metrics are dependent on the efficiency of your AI model in relation to the level and type of risk that it is subject to. This allows you assess whether the returns are worth the risk.

3. Monitor Portfolio Diversification to Reduce Concentration Risk

Tip: Use AI to help you optimize and manage the diversification of your portfolio.

Diversification helps reduce the risk of concentration. This happens when a portfolio is overly reliant on a single sector, stock or market. AI can help identify connections between assets and make adjustments to allocations to mitigate this risk.

4. Track Beta to Measure Sensitivity in the Market

Tip This coefficient can be utilized to assess the degree of the sensitivity that your stocks or portfolio have to market fluctuations.

Why: A portfolio with a beta greater than 1 is more volatile than the market. On the other hand, the beta of less than 1 indicates less volatility. Understanding beta is essential in determining the best risk-management strategy based on the risk tolerance of investors and market movements.

5. Implement Stop-Loss, Take-Profit and Risk Tolerance levels

To control losses and lock profits, set stop-loss or take-profit thresholds with the help of AI models for risk prediction and forecasts.

What's the reason? Stop-losses safeguard you from excessive losses, while take-profit levels lock in gains. AI can be used to identify optimal levels, based on prices and the volatility.

6. Monte Carlo simulations may be used to assess the level of risk in various scenarios.

Tips: Run Monte Carlo simulations to model an array of possible portfolio outcomes based on different risks and market conditions.

Why: Monte Carlo simulations provide a an accurate and probabilistic picture of the performance of your portfolio's future, allowing you to understand the risk of various scenarios (e.g., large losses, extreme volatility) and make better plans for the possibility of them.

7. Use correlation to determine the systemic and nonsystematic risk

Tip : Use AI to analyze correlations among the assets you hold in your portfolio and larger market indices. This will help you determine both systematic and non-systematic risk.

The reason is that while systemic risks are common to the market as a whole (e.g. downturns in economic conditions) while unsystematic risks are specific to assets (e.g. concerns pertaining to a specific business). AI can be used to identify and minimize unsystematic or correlated risk by recommending less correlated assets.

8. Monitor Value at Risk (VaR) to quantify potential losses

Tips: Value at Risk (VaR) which is based on the confidence level, can be used to calculate the probability of loss for an investment portfolio over a specific time frame.

What is the reason? VaR offers clear information about the worst-case scenario for losses, and lets you assess your portfolio's risk under normal market conditions. AI can be utilized to calculate VaR dynamically while adjusting to changing market conditions.

9. Set limit for risk that is dynamic in accordance with market conditions

Tip : Use AI to adjust the risk limit based on market volatility, economic conditions and connections between stocks.

The reason: Dynamic risk limits ensure that your portfolio is not subject to risk too much during times that are characterized by high volatility or uncertainty. AI can use real-time analysis to adjust in order to maintain your risk tolerance within acceptable limits.

10. Use Machine Learning to Predict Risk Factors and Tail Events

Tip: Integrate machine learning algorithms for predicting the most extreme risks or tail risks (e.g. market crashes, black swan events) using historical data and sentiment analysis.

What is the reason? AI models can identify risks patterns that traditional models could miss. This enables them to aid in planning and predicting rare, but extreme market situations. Tail-risk analyses help investors prepare for the possibility of catastrophic losses.

Bonus: Reevaluate your the risk metrics in light of changes in market conditions

Tips A tip: As the markets change, it is important to always reevaluate and review your risk models and risk metrics. Update them to reflect the evolving economic, financial, and geopolitical factors.

Why: Market conditions change often and using out-of-date risk models may lead to incorrect risk assessment. Regular updates will ensure that your AI models adapt to new risk factors and accurately reflect current market dynamics.

The final sentence of the article is:

By carefully monitoring risk metrics and incorporating them into your AI investment strategy, stock picker and prediction models, you can construct an intelligent portfolio. AI is a powerful tool that can be used to monitor and evaluate risks. Investors are able make informed choices based on data, balancing potential returns with risk-adjusted risks. These tips will allow you to build a solid management system and eventually increase the security of your investments. Take a look at the best trading chart ai for website recommendations including ai trading app, ai stock trading bot free, ai trade, ai stock trading bot free, ai penny stocks, ai stocks to invest in, ai stocks, ai trading software, trading ai, ai for stock market and more.